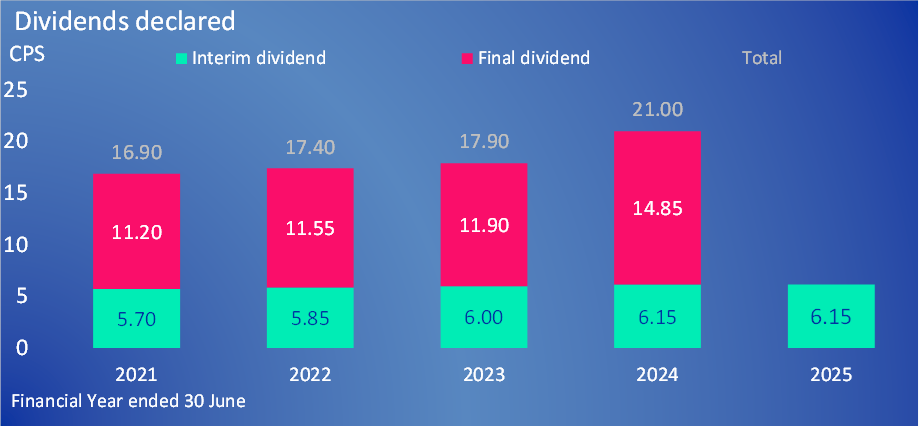

Dividends

Interim dividend of 6.15 cents per share, 85% imputed, to be paid on 25 March 2025

Interim dividend of 6.15 cents per share, 85% imputed, to be paid on 25 March 2025

Financial Year ended 30 June

Meridian’s ordinary dividend policy is to make distributions at a dividend payout ratio, within an average over time, of 80% to 100% of Operating Free Cash Flow, subject to the Board’s due consideration of:

Operating Free Cash Flow is calculated as Operating Cash Flow, less the annual capital cost of maintaining Meridian’s asset base and systems (Stay in Business Capital Expenditure).

New Zealand’s major banks have announced that from April 2021, they will no longer be issuing cheques. As a result, Meridian’s dividend payments are now made by direct credit only. If we do not have a bank account on file for you, your future dividend payments will have to be withheld by Meridian, until a bank account is provided.

If necessary, please contact Computershare to request a Direct Credit form by calling 09-488-8777 or by emailing enquiry@computershare.co.nz. Alternatively you may update your bank account details by visiting www.investorcentre.com/nz

Meridian has approved the establishment of a dividend reinvestment plan (“DRP”). Under the DRP, Shareholders may elect to reinvest the net proceeds of cash dividends payable on all or some of their fully paid ordinary shares in Meridian by acquiring further fully paid shares, free of brokerage charges. Any shareholder who does not choose to participate in the DRP will continue to receive their dividends in cash. Further details of the DRP and a copy of the DRP offer document and participation form will be released in August 2021.

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 6.15 cps | NZ 2.04 cps | NZ 0.92 cps | 07 March 2025 | 25 March 2025 |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 6.15 cps | NZ 1.91 cps | NZ 0.87 cps | 11 March 2024 | 26 March 2024 |

| Final Ordinary Dividend | NZ 14.85 cps | NZ 4.62 cps | NZ 2.10 cps | 05 September 2024 | 20 September 2024 |

| NZ 21.00 cps | NZ 6.53 cps | NZ 2.96 cps |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 6.00 cps | NZ 1.87 cps | NZ 0.85 cps | 08 March 2023 | 23 March 2023 |

| Final Ordinary Dividend | NZ 11.90 cps | NZ 3.70 cps | NZ 1.68 cps | 07 September 2023 | 22 September 2023 |

| NZ 17.90 cps | NZ 5.57 cps | NZ 2.53 cps |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.85 cps | NZ 1.96 cps | NZ 0.89 cps | 18 March 2022 | 08 April 2022 |

| Final Ordinary Dividend | NZ 11.55 cps | NZ 3.41 cps | NZ 1.55 cps | 08 September 2022 | 23 September 2022 |

| NZ 17.40 cps | NZ 5.37 cps | NZ 2.44 cps |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.70 cps | NZ 1.91 cps | NZ 0.87 cps | 31 March 2021 | 16 April 2021 |

| Final Ordinary Dividend | NZ 11.20 cps | NZ 3.75 cps | NZ 1.70 cps | 30 September 2021 |

15 October 2021 |

| NZ 16.90 cps | NZ 5.66 cps | NZ 2.57 cps |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.70 cps | NZ 1.91 cps | NZ 0.87 cps | 29 March 2020 | 16 April 2020 |

| Special Interim Dividen | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 29 March 2020 | 16 April 2020 |

| Final Ordinary Dividend | NZ 11.20 cps | NZ 3.75 cps | NZ 1.70 cps | 30 September 2020 |

16 October 2020 |

| NZ 19.34 cps | NZ 5.66 cps | NZ 2.57 cps |

cps: cents per share

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.70 cps | NZ 1.91 cps | NZ 0.87 cps | 29 March 2019 | 17 April 2019 |

| Special Interim Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 29 March 2019 | 17 April 2019 |

| Final Ordinary Dividend | NZ 10.72 cps | NZ 3.59 cps | NZ 1.63 cps | 30 September 2019 | 16 October 2019 |

| Final Special Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 30 September 2019 | 16 October 2019 |

| Total | NZ 21.30 cps | NZ 5.49 cps | NZ 2.49 cps |

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.38 cps | NZ 1.84 cps | NZ 0.84 cps | 29 March 2018 | 17 April 2018 |

| Special Interim Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 29 March 2018 | 17 April 2018 |

| Final Ordinary Dividend | NZ 8.94 cps | NZ 2.99 cps | NZ 1.36 cps | 28 September 2018 | 17 October 2018 |

| Final Special Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 28 September 2018 | 17 October 2018 |

| Total | NZ 19.20 cps | NZ 4.83 cps | NZ 2.20 cps |

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.33 cps | NZ 1.82 cps | NZ 0.83 cps | 31 March 2017 | 13 April 2017 |

| Special Interim Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 31 March 2017 | 13 April 2017 |

| Final Ordinary Dividend | NZ 8.70 cps | NZ 2.98 cps | NZ 1.35 cps | 29 September 2017 | 17 October 2017 |

| Final Special Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 29 September 2017 | 17 October 2017 |

| Total | NZ 18.91 cps | NZ 4.80 cps | NZ 2.18 cps |

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 5.10 cps | NZ 1.69 cps | NZ 0.77 cps | 31 March 2016 | 15 April 2016 |

| Special Interim Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 31 March 2016 | 15 April 2016 |

| Final Ordinary Dividend | NZ 8.40 cps | NZ 2.94 cps | NZ 1.33 cps | 30 September 2016 | 14 October 2016 |

| Final Special Dividend | NZ 2.44 cps | NZ 0.00 cps | NZ 0.00 cps | 30 September 2016 | 14 October 2016 |

| Total | NZ 18.38 cps | NZ 4.63 cps | NZ 2.10 cps |

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 4.80 cps | NZ 1.87 cps | NZ 0.85 cps | 31 March 2015 | 15 April 2015 |

| Special Interim Dividend | NZ 1.40 cps | NZ 0.54 cps | NZ 0.25 cps | 31 March 2015 | 15 April 2015 |

| Final Ordinary Dividend | NZ 8.08 cps | NZ 1.73 cps | NZ 0.79 cps | 30 September 2015 | 15 October 2015 |

| Final Special Dividend | NZ 3.95 cps | NZ 0.00 cps | NZ 0.00 cps | 30 September 2015 | 15 October 2015 |

| Total | NZ 18.23 cps | NZ 4.14 cps | NZ 1.18 cps |

| Dividends Declared | Amount per Security | Imputed per Security | Supplementary amount per Security¹ | Record Date | Payment Date |

| Interim Ordinary Dividend | NZ 4.19 cps | NZ 1.47 cps | NZ 0.67 cps | 31 March 2014 | 15 April 2014 |

| Final Ordinary Dividend | NZ 6.82 cps | NZ 2.39 cps | NZ 1.08 cps | 30 September 2014 | 15 October 2014 |

| Special Final Dividend | NZ 2.00 cps | NZ 0.70 cps | NZ 0.32 cps | 30 September 2014 | 15 October 2014 |

| Total | NZ 13.01 cps | NZ 4.56 cps | NZ 2.07 cps |

¹Supplementary dividends paid to investors who are not resident in New Zealand

Meridian has approved the establishment of a dividend reinvestment plan (“DRP”). Under the DRP, Shareholders may elect to reinvest the net proceeds of cash dividends payable on all or some of their fully paid ordinary shares in Meridian by acquiring further fully paid shares, free of brokerage charges. Any shareholder who does not choose to participate in the DRP will continue to receive their dividends in cash.

Meridian Energy operates a Dividend Reinvestment Plan which offers Shareholders the opportunity to directly increase their investment in Meridian Energy. Details on reinvestment choices can be found in the offer document below.

The Plan enables shareholders to reinvest all or part of the net proceeds of cash dividends paid on their Meridian Energy Shares in additional Meridian Energy Shares, instead of receiving those dividends in cash.

As at the date of the Offer Document, the Plan is only available to shareholders who have an address on the Meridian Energy share register in New Zealand or Australia.

The Board may amend this policy at any time, at its sole discretion.

No.

There are no charges for participating in or withdrawing from the Plan or changing the number of Shares nominated by you that will participate in the Plan. No brokerage or commission costs will be payable in respect of the Shares you receive under the Plan.

You should read the Offer Document carefully before deciding whether to participate. You can elect to participate at any time by completing and returning a Participation Notice to Meridian Energy’s Registrar, Computershare Investor Services:

Registrar in New Zealand, Computershare Investor Services Limited

Postal address: Private Bag 92119 Auckland 1142 New Zealand

Registrar in Australia, Computershare Investor Services Pty Limited

Postal address: GPO Box 3329 Melbourne VIC 3001 Australia

You can also scan your Participation Notice and email it to drp@computershare.co.nz Online Participation Notices can be completed by visiting the website of the Registrar, Computershare Investor Services at www.investorcentre.com/nz.

New Zealand-registered holders will need their CSN/Holder number and FIN to complete the investor validation process. Australian registered holders will need their Holder number and postcode to complete the investor validation process.

If you wish to participate in the Plan for the upcoming dividend, you will need to return your Participation Notice by no later than 5pm on 1 October 2021.

Participation in the Plan is optional. If you wish to participate in the Plan, you may elect:

If you do not wish to participate in the Plan, you do not need to do anything. You will continue to receive cash dividends on your Shares.

You can join the Plan or vary your participation at any time by either contacting Meridian Energy’s Registrar, Computershare Investor Services online at www.investorcentre. com/nz or delivering an updated Participation Notice to the Registrar. Participation Notices are available online or from the Registrar on request.

If you choose to participate in the Plan and then change your mind, you can opt out by informing the Registrar either online or by completing a Cancellation Form (available online or from the Registrar on request).

Such variation or cancellation will be effective immediately provided that any Participation Notice or Cancellation Form that is received after 5pm on an Election Date will be effective for the following dividend.

The price of Shares is based on the volume-weighted average sale price of Meridian Energy Shares sold on the NZX Main Board over a period of five Business Days starting on the “Ex Date”. Please see the Offer Document for further details.

The Share price may be subject to a discount set by the Board from time to time. The discount, if any, will be announced by Meridian Energy to Shareholders at the same time the dividend is announced for the relevant period.

Yes. The Meridian Energy Board may change, suspend or cancel the Plan at its sole discretion. If that occurs, notice will be given through the NZX and ASX as required by the terms and conditions of the Plan.

Yes. Shares acquired under the Plan can be sold at any time.

The taxation consequences for each shareholder should they elect to participate in the Plan will depend on their particular circumstances. Accordingly, each shareholder should consult their own tax adviser as to the taxation implications of the Plan. Meridian Energy does not accept any responsibility for the financial or taxation effects of a shareholder’s participation or non-participation in the Plan.

Shortly after the allotment of Shares under the Plan, Computershare Investor Services will send all Plan participants an updated Securities Transaction Statement, along with a dividend remittance advice.