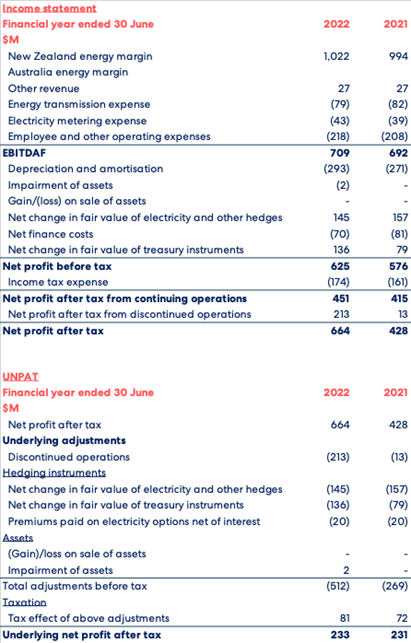

Meridian Energy has reported underlying net profit after tax1 of $233 million, a slight increase on the prior year figure of $231 million. EBITDAF2 for the year was $709 million, up $17 million or 2.5% on the prior year. Including the benefit of a $214 million gain on the sale of its Australian business and $281 million of positive non-cash movements in the value of hedge instruments, Meridian Energy has reported $664 million of net profit after tax for the year ended 30 June 2022.

Chief Executive Neal Barclay says, “Meridian has had a challenging, but successful year. We’ve navigated another significant drought, grown our customer base, built out our development pipeline and maintained momentum on the construction of our Hawke’s Bay wind farm – Harapaki.

“We’ve also progressed a hydrogen option and believe we’re developing a credible opportunity not only for our business, but for Southland and our national economy,” adds Barclay.

The Board declared a final ordinary dividend of 11.55 cents per share, 3% higher than the previous year. This brings the total ordinary dividends declared in FY22 to 17.40 cents per share, also 3% higher than the previous year.

Our annual report for FY22 can be found here.

Customers

Meridian has continued to focus on customers first. Mass market and corporate sales volumes continue to grow. Overall, sales by our Powershop and Meridian brands have grown by more than 50% in the last three years. This month, Powershop won Consumer New Zealand’s People’s Choice award and came top in the power company satisfaction survey. The Meridian brand also polled above industry average and ahead of its gentailer peers.

During the year Meridian launched a new Energy Wellbeing programme for vulnerable customers. The programme looks to reduce the impact of four key drivers of energy hardship - financial, housing quality, energy supply and energy efficiency through in house specialists and support from partners.

“Through this pilot we have proven retailers can make a difference beyond the boundaries of energy supply. We’re looking forward to scaling this project in the new financial year,” adds Barclay.

Meridian also established a new Energy Solutions team to advance options for distributed generation and demand response. This will build on the company’s commitment to build out the delivery of both commercial-scale solar and our residential EV offers.

Renewable energy growth

Meridian has made progress building out a development pipeline with options secured across wind, solar and batteries sites. Meridian’s development pipeline sits at 2.4GW, made up of 1.2GW in secured options and advanced prospecting of 1.2GW.

At the Ruakᾱkᾱ Energy Park in Northland, Meridian is currently tendering for 100/200MWh Battery Energy Storage System (BESS). Meridian is also planning a 75MW solar farm at this site.

The BESS will increase South-North Island power transfer, support grid stability and supply electricity regionally and nationally. Both projects will also improve Northland energy security.

“Our development team is working hard to get consents approved for the battery by the end of September 2022, with construction projected to start in 2023 and completion in late 2024. We aim to lodge consents for the solar farm by early 2023, with construction anticipated early 2024 and completion early 2025,” says Barclay.

Meridian’s Hawke’s Bay wind farm Harapaki, currently under construction, has experienced some cost escalation due to weather and general inflationary pressures. But pleasingly the project remains on track with first power scheduled for June 2023 and full power in June 2024.

“The team working at Harapaki have navigated a number of challenges successfully. The impact of these challenges has meant that we’ve had to spend more money on this project than anticipated to maintain the construction timeline. The Board has approved an increase in capital expenditure to ensure we deliver this nationally significant project on time,” adds Barclay.

A full disclosure on the project can be seen here.

Process Heat conversion

Meridian’s programme to support large users of process heat to convert to renewable solutions met its ambitious target of securing over 300GWh of committed load in the financial year.

“Our proposition here is unique and we’re responding to increasing calls to help customers who have significant process heat requirements to make the changes they need for their business and the climate,” says Barclay.

Meridian welcomed the acceleration of investment in the Government Investment in Decarbonising Industry (GIDI) Fund this year, with a further $650 million being prioritised to support the industry reduce emissions.

meridianenergy.co.nz

“The collective actions of businesses will continue to require the support of Government on this journey. The package of policy measures released from the Climate Emergency Response Fund this year are essential if Aotearoa is to gain the momentum required to meet our climate action goals,” says Barclay.

Southern Green Hydrogen

The Southern Green Hydrogen project team, a collaboration between Meridian and Contact Energy, is nearing a decision on who will be selected as the lead development partner. Two partners have been shortlisted, Woodside Energy and Fortescue Future Industries. Both partners are developing detailed proposals and we expect to make a final selection later this year.

The aim of this project is to set a pathway that will see a large new player enter the electricity market and create immediate scale for a new green hydrogen industry in Aotearoa. Ultimately, we see this project as being foundational for New Zealand becoming energy independent and insulated from highly volatile international energy markets.

MEA sale

In late January, Meridian completed the sale of its Australian business to the consortium of Shell Energy Operations Pty Ltd, a wholly owned subsidiary of Shell and Infrastructure Capital Group (ICG) with a final sale price of A$740 million, and a NZ$214 million gain on sale.

Those sale proceeds will support us to go after a number of opportunities that support our renewable growth strategy and help meet the country’s ambition to decarbonise,” says Barclay.

Climate Action

Half by 30 is Meridian’s ambitious commitment to halve our FY21 baseline emissions by FY30. The Science Based Targets initiative (SBTi) has approved Meridian Energy’s near-term target to reduce absolute scope 1&2 and scope 3 emissions by 50%. The scope 1&2 target has been classified as 1.5°C aligned by the SBTi. Our Climate action plan lays out our plan for achieving our Half by 30 commitment. Meridian has also committed to set long-term emissions reduction targets with the SBTi in line with reaching net-zero by 2050.

People

This year the Board and Management recognised the efforts of our staff against the context of economic strain, challenges, and pressures. In addition to our ongoing development of leaders and culture, Meridian’s remuneration increases have reflected the cost of living challenges our people are experiencing. The Board has also approved a one off $1,000 bonus for non-executive staff.

“The talent and commitment of Meridian people are key to the results we deliver. We’re thankful for their efforts during this challenging year,” says Barclay.

[1] Net profit before tax adjusted for the effects of changes in fair value of hedges and other non-cash items. Underlying net profit after tax is a non-GAAP financial measure. Because they are not defined by GAAP or IFRS, Meridian’s calculation of such measures may differ from similarly titled measures presented by other companies and they should not be considered in isolation from, or construed as an alternative to, other financial measures determined in accordance with GAAP. Although Meridian believes they provide useful information in measuring the financial performance and condition of Meridian’s business, readers are cautioned not to place undue reliance on these non-GAAP financial measures. A reconciliation of underlying net profit after tax is included on page 4.

[2] EBITDAF is a non-GAAP financial measure but is commonly used within the electricity industry as a measure of performance as it shows the level of earnings before impact of gearing levels and non-cash charges such as depreciation and amortization. Market analysts use the measure as an input into company valuation and valuation metrics used to assess relative value and performance of companies across the sector.

ENDS

Neal Barclay

Chief Executive

Meridian Energy Limited

| For investor relations queries, please contact: Owen Hackston Investor Relations Manager 021 246 4772 |

For media queries, please contact: Meridian Energy Media Team 0800 948 843 MediaTeam@meridianenergy.co.nz |